In a world where teachers are often overworked and underpaid, it’s essential to explore ways to augment salaries without overexerting oneself. One such avenue is through Teaching and Learning Responsibility payments. TLR payments are additional payments made to teachers who take on extra responsibilities, and they can be a crucial stepping stone for those aiming for a Senior Leadership Team (SLT) role.

There are three levels of payments: TLR1, TLR2, and TLR3, each with its own set of responsibilities and corresponding pay increase.

Understanding Teaching and Learning Responsibility Levels

Navigating the different levels of Teaching and Learning Responsibility payments can be a bit daunting, but understanding the distinctions is crucial for teachers looking to augment their salary while taking on additional responsibilities that align with their career goals and current workload.

TLR2

The initial step when seeking extra payment is TLR2. Teachers with distinct teaching responsibilities, typically subject leadership, are eligible for this payment. Responsibilities may include monitoring and supporting other staff, but a line manager’s role is not expected. If you are already a subject leader and not on TLR2, consider making a case for it. TLR2 payments is set at £3,017 to £7,368, depending on your experience and contribution level.

TLR1

TLR1 payment is akin to TLR2 but necessitates being the line manager for a significant number of staff, like a department. It is a crucial step towards becoming an SLT member and involves taking on substantial additional long-term responsibilities. Pursuing a TLR1 role would add between £8,706 to £14,732 to your salary, making it a considerable pay increase. Note that you cannot receive both TLR1 and TLR2 payments simultaneously.

TLR3

TLR3 payment is granted for managing projects at the school with limited responsibility and over a short duration, such as facilities enhancements or introducing a new subject curriculum. TLR3 payment must be no less than £600 and no greater than £2,975 and can be accepted anytime in addition to any other payments received.

What are SEN/ALN allowances

The STPCD outlines that teachers are eligible for special educational needs allowances concerning their work with children having special needs. In Wales, this corresponds to the additional needs allowance (ALN).

These allowances are required to be provided to teachers in special schools or in positions involving SEN/ALN where a mandatory qualification in SEN/ALN is necessary. They are also mandated for teachers instructing pupils with SEN/ALN in specified special classes/units or within local authority services/units. Furthermore, they must be granted to teachers in mainstream schools or pupil referral units (PRUs) where the environment resembles a designated special class or unit and meets specific criteria.

The governing body determines these allowances by considering the school’s SEN/ALN framework, pertinent qualifications, expertise relevant to the role, and the inherent demands of the position. According to statutory guidance within the STPCD, teachers can concurrently hold SEN/ALN allowances alongside TLRs. Teachers meeting the statutory criteria are entitled to an appropriate allowance, ranging from a minimum of £2,384 to a maximum of £4,703 in England, commensurate with their skills and experience in the role. In Wales, the range stands at £2,426 to £4,786.

Please note that these figures are for the 2022–2023 academic year and may change annually.

Are TLRs permanent or temporary?

TLR1 and TLR2 payments are granted for the duration of a teacher’s tenure in their current position. These payments will discontinue upon the teacher’s relocation to a different school, refusal to fulfill responsibilities, dismissal from duties, or when responsibilities undergo revision. TLR3 payments, as outlined below, are time-bound and have a fixed duration.

A teacher is restricted to holding either a TLR1 or TLR2 payment, but a singular TLR payment can encompass various significant responsibilities outlined in a detailed job description. Additionally, a teacher is now permitted to receive one or more TLR3 payments alongside a TLR1 or TLR2 payment.

Introducing Custom School Resources

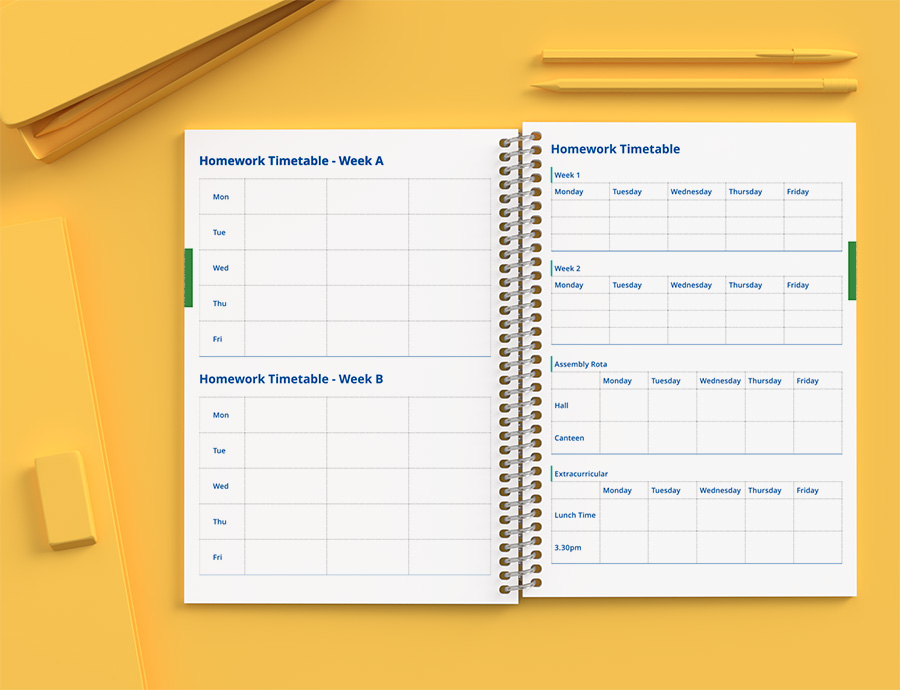

Another way to add value to your school and potentially earn a TLR3 payment is by introducing custom school resources, such as custom exercise books and student planners. These resources can be tailored to the specific needs of your students and can help enhance overall student achievement. For example, custom exercise books can include subject-specific content, study tips, and practice exercises, while custom student planners can include school-specific information, important dates, and study planning tools.

Propose the idea of introducing custom school resources in your next departmental meeting and discuss how they can enhance overall student achievement and the usefulness of whole-school staff planners for busy teaching staff. If your proposal is accepted, you could be responsible for managing the project, which could earn you a TLR3 payment.

Other Ways to Augment Your Salary

Beyond your regular salary, there are practical strategies to boost your earnings in the teaching profession. Exploring additional opportunities can all contribute to maximising your pay.

- Professional Development: Emphasise the importance of continuous professional development. Not only does this make you a better teacher, but it also makes you more valuable to your school and can lead to higher pay. Many schools offer financial incentives for teachers who earn advanced degrees or additional certifications.

- Negotiation: Don’t be afraid to negotiate your salary. Do your research on average salaries for your position, experience, and location. If you believe you are being underpaid, prepare a case for why you deserve a higher salary and present it to your school’s administration.

- Additional Opportunities: Look for additional opportunities within your school that may come with a stipend. This could include coaching a sports team, advising a club, or taking on additional administrative tasks.

- Union Membership: If you are a member of a teachers’ union, they may be able to provide guidance and support in securing higher pay or additional benefits.

- Tax Deductions: Make sure you are taking advantage of all available tax deductions for teachers. This won’t increase your salary, but it can help your money go further.

- Grants and Fellowships: Apply for grants and fellowships. There are many opportunities available for teachers, and these can provide additional funds for your classroom or professional development.

In conclusion, TLR payments are a great way for teachers to increase their salary without overexerting themselves. Assess your role and duties annually, and initiate conversations with your school about payments if you believe you qualify. Additionally, consider other ways to augment your salary, such as professional development, negotiation, and additional opportunities within your school. Remember, it’s important to balance additional responsibilities with your workload to avoid burnout. Your well-being is crucial, and it’s important to take care of yourself in order to be the best teacher you can be.

Stand Out in Class with Customized School Essentials!

Discover How The School Planner Company can support you with customised school essentials. Learn More Now!